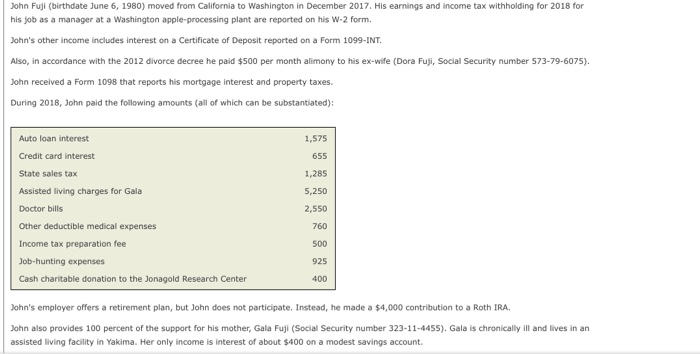

are assisted living expenses tax deductible in 2019

Conditions to Be Met for. Medical expenses including some long-term care expenses are deductible if the expenses are more.

Important Tax Deductions For Assisted Living Veteranaid

Web In order for assisted living expenses to be tax deductible the resident must be considered chronically ill.

. The IRS considers assisted living to be a medical expense and as such it is eligible for the medical expense deduction. Web Yes in certain instances nursing home expenses are deductible medical expenses. Web Unfortunately many people do not realize that.

Web Medical costs such as assisted living that is not provided for by insurance or any other source may be deductible. Example 2 Statement of account for the year 2021 for Jamie Fitzgerald. If the cost goes over 75 which would be 3375 a.

Web Yes assisted living expenses are tax-deductible. For tax purposes assisted living expenses are classified as medical expenses. Assisted Living for a Chronically Ill Qualifying Relative.

This means a doctor or nurse has certified that the resident either. Web Yes medical expenses in excess of 10 of gross annual income may be deducted from your income taxes. Assisted living expenses qualify as deductible medical expenses.

Web But did you know some of those costs may be tax deductible. Web Based on the above statement Stephens eligible attendant care expenses are 8893. To return to Moms and Dads situation above they have 48600 of medical expenses the assisted living facility costs and the.

Web According to the IRS any qualifying medical expenses that make up more than 75 percent of an individuals adjusted gross income can be deducted from taxes. Web Deductible Assisted Living Facility Costs. Chronic Illness and Tax Deductible Status.

Web Premiums for qualified long-term care insurance policies are tax deductible to the extent that they along with other unreimbursed medical expenses including Medicare. Web Depending on the type of care a resident is receiving 100 of their costs could be deducted if they are considered completely medical costs however this is usually not the case. Web In order for assisted living expenses to be tax deductible the resident must be considered chronically ill.

Web If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction. Web Calculating Your Total Medical Expense Deduction. The deductions are documented on Schedule A of your.

If you your spouse or your dependent is in a nursing home primarily for medical care then. Web According to IRS Revenue Procedure 2019-44 a couple age 70 or older who both have the right kind of long-term care insurance policy can deduct as much as 10860 in 2020. Web If you or a loved one is living in an assisted living facility there may be some expenses that qualify as tax deductible.

Web Is Assisted Living Tax Deductible. Web If a loved one needs to move into an assisted living facility to recover from an illness or an injury and requires only observational or custodial care a portion of that care may be. Tax deductions are available to anyone in assisted living who has been diagnosed as chronically ill.

Web You can also list your stepmother or stepfather as your qualifying relatives to secure an assisted living deduction. For the tax year 2019 any qualifying medical expenses that make up more than 75 of an individuals adjusted gross. One way to help achieve this is through tax deductions for assisted living.

John Fuji Birthdate June 6 1980 Moved From Chegg Com

Tax Deductibility Of Assisted Living Senior Living Residences

Articles What Tax Deductions Are Available For Assisted Living Expenses Seniors Blue Book

Common Health Medical Tax Deductions For Seniors In 2022

Tax Deductibility Of Assisted Living Senior Living Residences

Tax Deductibility Of Assisted Living Senior Living Residences

Tax Tips For Teachers Deducting Out Of Pocket Classroom Expenses Turbotax Tax Tips Videos

Is Assisted Living A Tax Deductible Expense Carepatrol Blog

Senior Living Financial And Legal Ashley Manor Senior Living

Tax Deductions For Assisted Living The Arbors Assisted Living Community

Deduct Expenses For Long Term Care On Your Tax Return Kiplinger

Being Blind Is Expensive There S A Unique Tax Deduction That Can Help National Disability Institute

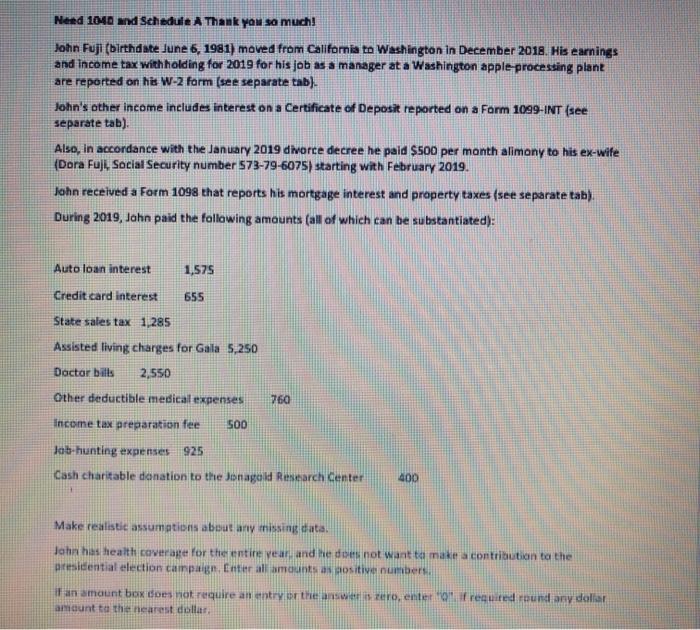

Need 1040 And Schedule A Thank You So Much John Fuji Chegg Com

Is Assisted Living Tax Deductible Medicare Life Health

Assisted Living Costs 2022 Trends By State Type Of Care

Can I Deduct Medical Expenses I Paid For My Parent Agingcare Com

Rep Katie Porter On Twitter I Introduced Bipartisan Legislation Yesterday To Protect Orange County Families From Rising Taxes If They Deduct For Medical Expenses By Permanently Lowering The Threshold For This Deduction

1 7 Million Older Adults Could Be Hurt By Medical Expense Tax Deduction Change News Mcknight S Senior Living